Dad, are we poor?

December 14, 2015

Life/Disability Insurance, do I really need it?

February 14, 2016I was forwarded the following article recently (hold off reading for a minute). Normally the article title alone would have been enough for me to not bother reading it, as I could only see the first part, “I retired at 30”.

Probably just another get rich quick story to be avoided I thought. Maybe I was a little jealous also as I’m more than a couple of years past 30. But it came via a source I respected so thought I’d have a quick look. As the full heading, “I retired at 30. The best part isn’t leisure — it’s freedom.”, suggests there is much more to the article.

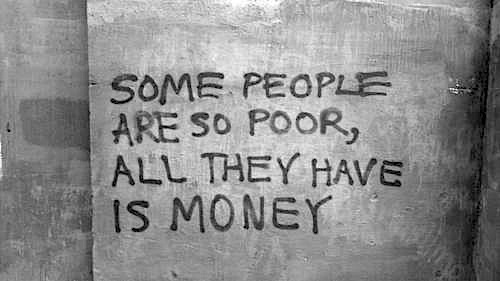

There is an overwhelming focus in our lives on income. Basically, most of us always want more of it thinking this is the solution to all our personal and financial issues. If only I had a bit more income everything would be OK, so we chase more by working longer and harder, often doing things we don’t enjoy. This young couples approach was refreshingly different. Their focus was expenses.

Once they knew the expenses associated with their desired lifestyle (we’ll leave this matter for another day) it was a relatively simple exercise to work out how much capital they needed to free themselves from the need for employment income (i.e. to retire) and be financially independent. Now this is all very good, but probably not very useful. As it says in the article it’s not easy, but it is simple.

As per the article, what makes it easier are the reasons you want to be financially independent and free from the need for employment income. If your reasons for doing something are important enough to you, in other words you are motivated enough, your likelihood of success is greater. The first step in your planning is always to ask: what’s important to me?; what does that actually mean?; what does it look like (be specific)?

The other important issue raised in the article is the concept of retirement or financial independence. We’ve been conditioned to think of retirement and even financial independence as lines in the sand where you cross from being part of the paid workforce to a life of leisure. Having worked with hundreds of people in the pre/post “retirement” phase of their lives, this is an overly simplistic view of how we live our lives.

I think we need to stop using the word “retirement” because of the misconceptions it brings with it. What we are really talking about is best summed up using the author’s words,

“It is more about freedom to do your best work, without money getting in the way”.

If you could choose, what would you do with your time?

What are you doing about it?

I retired at 30. The best part isn’t leisure — it’s freedom.

by Mr. Money Mustache on July 27, 2015

When somebody finds out that I retired 10 years ago at age 30, the first question that comes up is usually, “How?!”

This leads to a series of skeptical questions about how anybody could possibly save enough in 10 years of work to live off for the remaining 70, or how I handle raising kids, health insurance, college tuition, emergencies, groceries, and luxuries.

But that’s all just the nuts-and-bolts stuff. For anyone familiar with the principles of personal finance and investing, my trick was unimpressive and easily reproducible: Just spend much less than you earn and pour the difference into efficient index funds. When your collection of investments reaches 25 times your annual spending, you’re done.

Much more interesting is the debate over whyanybody would want to retire at 30

Occasionally an angry heckler with credit card balances and car loans will insist that my impossible tale is all fabricated, which is sort of like a person who has trouble climbing 10 flights of stairs insisting that a 200th-place marathon runner must have cheated his way across the finish line because nobody could possibly run that far. Like running 26 miles, accumulating enough money for early retirement is not really easy, but it’s pretty simple.

Much more interesting is the debate over why anybody would want to do this. After all, if you look at the accomplishments of humankind over the last few thousand years, you can see that at the core, we really love to work. We don’t just stop at food and shelter like every other species — we go on and on to create cathedrals, concerts, spaceships, and genetic maps. Meanwhile, with so many of us still starving and/or killing each other, you could argue that there is plenty of work left to do.

More on early retirement

This blogger retired at 30, and he wants to show you how you can do it too

How to retire in your 30s: save most of your money and rethink your core values

On the other hand, not every job is quite as rewarding as creating art or saving the world. Here in the US, around two-thirds of us are dissatisfied with our workplace and would probably quit if we really had the option. Most of the remaining people would at least welcome a longer weekend every now and then, or the chance to take a month or two off in the summer if the paychecks would remain uninterrupted. It is these smaller enticements that I usually try to plant as seeds when sharing the idea of what early retirement is really like.

Initially, my own reason for early retirement was the desire to be a good dad. My long-time girlfriend and I knew that marriage was coming up on the horizon, and we planned to start a family. But when we looked around at our engineering colleagues, we could see that the demands of young children did not work well with the all-encompassing nature of a career in high tech. How could we both be dedicated to these jobs, working late and answering emails on the weekends, while also supplying the 12 to 16 hours a day of attention that a toddler sucks up? Leveraging our frugal 1970s upbringings in a less wealthy country and our new above-average incomes, we decided to live below our means and save for financial independence before becoming parents ourselves.

All that turned out to be just the start of a much bigger experiment. Ten years ago, I realized I was onto something good when my baby son was born and I didn’t have to fight for a few weeks of paternity leave. I had no desire to return to the office during those first months of sleepless “hit by a freight train” baby care. But as the seasons and years wore on and free time started shining down from the sky again with increasing frequency, I came to realize that work is a far more essential part of life than I had ever guessed.

What if work were something that you did only when it worked for you? If you could go at it with gusto on certain days, or even certain seasons or years, but then shift to other things for a while when your priorities changed? You might spend most of your 20s burning up the corporate ladder or being the workhorse that keeps a startup company in the black. But then your 30s might be mostly consumed by bringing up young children, your 40s might see you starting more companies or reclaiming your youth as a touring rocker, and your 50s and 60s are yet to be charted. Now that I’ve met a large number people who have actually followed this path, I can see that financial independence isn’t so much about freedom from work. It is more about freedom to do your best work, without money getting in the way.

This is what I’m really describing when I talk about early retirement. It’s not really retirement at all, but that’s because I don’t think anybody should truly retire in the old sense of the word — swearing off all forms of paid activity in favor of a dramatic increase in television watching and golf playing. Creation of new ideas, new enterprises, or new things is the biggest joy of being alive. Learning more about life, the world, and yourself and then trying to mix the ingredients together to the best of your ability is the happiest path you can take as a human. We’re uniquely lucky to even have such an option available to us these days.

Financial independence isn’t so much about freedom from work. It is more about freedom to do your best work, without money getting in the way.

So in my own case I started just with the goal of being a parent, but then ended up starting a house-building company to pursue my lifelong love of building things. Then I learned that the daily stress and schedule of big, multi-person projects was still too much for me at the time, so it evolved into a boutique carpentry operation that still does local projects to this day. Other ventures have come and gone, but none of them were done because we needed the money. That is my definition of a modern retirement: the activities you pursue once you are done searching for money.

Like an old-time homesteader, I enjoy learning new skills as the opportunity comes up, because I find it’s more satisfying to learn something than to outsource it to others, even if you can afford it. Housekeeping and haircutting, cooking and gardening, but also welding and plumbing, framing and roofing, heating and cooling, auto repair and strength training, drum playing and electronic dance music composition and beer brewing are just a few of the things I have had the joy of working on in this first decade of retirement.

Somewhere in there I also started a blog with the goal of reducing the rich world’s resource consumption while suggesting that we could all have a lot more fun in the process. It was done mostly on a whim and only possible due to the free time available in the absence of a real job. But even this side gig has blown up into something much more fun than my original work career and is in fact what has brought you and me together at this very moment.

Even though some of these activities may look like “work,” the word “retirement” is still a very good one to describe all of this freedom, because it does require you to make a pretty big escape from social norms. Our society is built upon a series of assumptions that you need to examine and then throw away if you want to get here before everyone else. For example, would a Mercedes ML550 with leather seats provide you with a happier life than a Toyota Corolla with a manual transmission? Would a Harvard doctorate give your child a happier life than a bachelor’s degree from a lesser university? And while we’re at it, what are the happiest choices in fashion, convenience, travel, dining, shopping, and lawn care? Most of us consistently get the answers to these questions wrong.

In general, we’ve been trained to always seek the highest level of luxury and the minimum level of personal effort, except in the area of work, where maximum exertion from age 25 through 67 is the only moral choice.

Taken to the extreme, a few of us would be permanently floating in an infinity pool while servants delivered gourmet meals and opened the boxes of an incoming stream of high-end products for our amusement. The only possible improvement would be the addition of a bedpan and a catheter.

The rest of us would be straining and struggling, out of shape and deep in debt, short on time and wondering why life is so difficult and yet so unsatisfying. When I look at the life of the middle class today, it seems we creep a little closer to this extreme every year. The standard practice of newspaper articles is to blame a system that prevents the middle class from getting ahead, but I think it’s a much bigger problem: a middle class that is permanently caught up chasing the idea of “more,” which of course you can never catch.

The solution is to duck out the side door of this suffocating circus tent and seek out a completely different and better life. Instead of shopping for the easiest life you can afford, look for the most challenging one you can handle with your current level of ability. Instead of the closest elevator, find the highest staircase. Forgo the longest drive in the fanciest car for the most consistent walk in the most varied weather. As you produce more value for the world and increase your income, simultaneously increase your efficiency and decrease your material needs. As you buy fewer treats for yourself, your level of satisfaction and happiness with life will increase.

This is both the recipe for financial independence, and the reason you’ll never want to sit around and do nothing once you get there. Because work becomes better once you have the freedom to choose how and when you do it. And better work is worth working harder at.

It’s all a giant circle. I just wish everyone were allowed to see this happy secret.

Mr. Money Mustache (Pete Adeney in real life) grew up in Canada and worked a 10-year career in software engineering before retiring from the field in 2005 at age 30. He is now primarily a family man with one 9-year-old son, and a side interest in the intersection of social change with the world’s energy and resource consumption. You can find all of his writing on finance, lifestyle, and early retirement at mrmoneymustache.com.

Disclaimer

This advice is of a general nature only and may not be relevant to your particular circumstances. The circumstances of each person are different and you should seek advice from a financial planner who can consider if any strategies or products mentioned are right for you.