Fees for No service

June 20, 2017

This Ain’t No Joke

October 10, 2017In prior posts, we have highlighted the value in pursuing simple solutions, over complex or simplistic solutions. It has also been highlighted that our desire as humans to feel special can lead us to the misconception we must seek out “special” solutions, which not surprisingly come at a significant price and in reality aren’t special at all.

I would like to pick up on da Vinci’s quote as providing sage direction on how much of your financial life should be structured. Take a moment to consider what is being said. It’s probably more profound now than it was 500 years ago. Never has there been a period in history of having more and wanting more.

Financial World – Complexity without Sophistication

25 years ago, I briefly worked for one of the big 4 banks and the target at the time was to get bank customers to an average of 2.5 products. The theory was simple and very effective. Once you introduce enough complexity, via the number of products, it’s too much hassle to move and the bank gains pricing power over the customer. Nearly all of us will have experienced this at some point.

In the financial advice world there is also a tendency to introduce complexity to either suggest the client is getting something special or to make the adviser an integral part in the process. It’s more about the advice provider than it is about the client and again one gains pricing power over the other.

Strategic Complexity – Usually Good

The strategic aspects of the advice process can often seem complex from the client perspective, which is very understandable as terminology can often be foreign and some structuring arrangements can seem, and sometimes are, illogical. This complexity typically stems from taxation and social security legislation, with the latter driven more by policy than logic. However, in the vast majority of cases the benefits to the client of strategic measures will be clear and compelling and from the adviser side of the table they are typically not that complex, as they are being done on a regular basis. Complexity can be good, but the benefits must be clear and compelling.

Investment Complexity – Usually Bad

When it comes to the investment aspect of the advice process, however, this is where things can become complex for no clear or compelling benefit to the client. There is a tendency in the advice community to use investment platforms for the benefit of the advice provider and a large number of investments for the sake of creating complexity, again for the benefit of the advice provider.

An investment platform (super or non-super) is used by the majority of financial planning practices under the banner of simplifying or streamlining the delivery of advice. This is the story being sold by product providers and accepted by advice practices. Sorry to say, it’s more about the product provider and advice practice than it is about the client, as it almost always leads to the client paying more than they need to. Often you will not even be able to interact with the chosen investment platform without an adviser, or where you do you will have to pay the platform a greater fee.

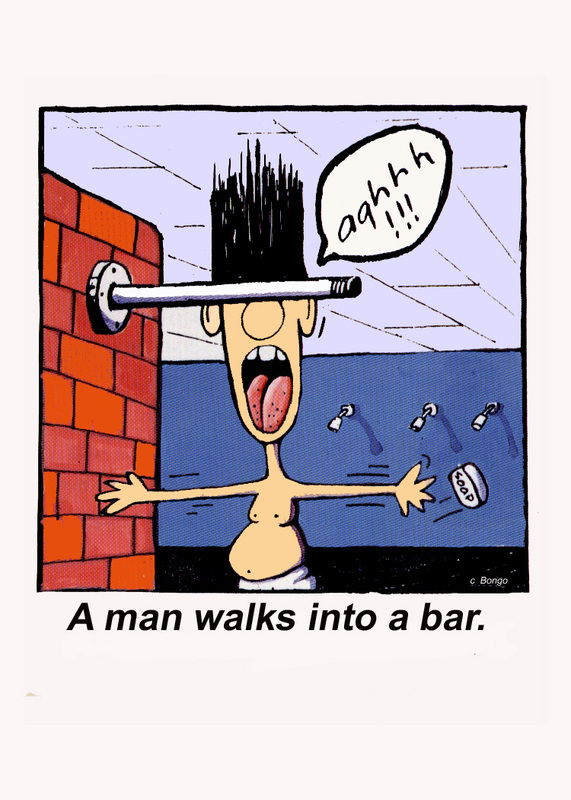

A large number of investment options are often recommended to tailor the portfolio to your unique position, based on extensive and robust research, or at least that’s the sales pitch. To the client the portfolio will look complex and sophisticated. Feeling special? The reality is that most of the time the portfolio will not actually be sophisticated at all, just complex, and destined to deliver average performance at a premium price.

Client Outcome – Usually Ugly

The problem with this environment is that it comes at a cost to the client, you. While the advice practice gets the efficiency benefits of using the investment platform, the client pays for it via additional investment administration and management fees. The client also pays via additional advice fees to manage the complexity that has been introduced by numerous investment options.

If you believe that special investments are necessary for you to feel special then continue seeking it out and paying for the privilege. If you believe ultimate sophistication can be found in simplicity then you should also seek it out and you will reap the rewards.

PS

A common question from clients is whether they should have more than one super fund for diversification purposes. The simple answer is no. It would be rare that one super fund will not be able to provide adequate diversification. Too much diversification is not beneficial. It is simply unnecessary, and often expensive, complexity.

Another question is whether an industry fund is adequate. The simple answer for 99% of the population is yes. While there are a few with very limited investment flexibility and with costs on the high side, the majority have plenty of investment flexibility and very competitive fees. Just make sure it does what you need/want it to cost effectively.

Disclaimer

This advice is of a general nature only and may not be relevant to your particular circumstances. The circumstances of each person are different and you should seek advice from a financial planner who can consider if any strategies or products mentioned are right for you.