The Eighth Wonder of the World

November 14, 2015

The New Meaning of Retirement

January 14, 2016A few weeks ago our daughter asked if we were poor. We don’t spoil our kids, but still this question came as a bit of a surprise, as they don’t go without much either.

I asked her why she thought we were poor. “Because we don’t drive a new car or live in a fancy house.” The answer was illuminating.

Putting the dented ego aside (I didn’t think our car was that old or our house that plain) her answer highlights at least two issues that stand in the way of many achieving financial success, and you could argue greater personal success and happiness. The first relates to perceptions of financial success. The second is how we measure success.

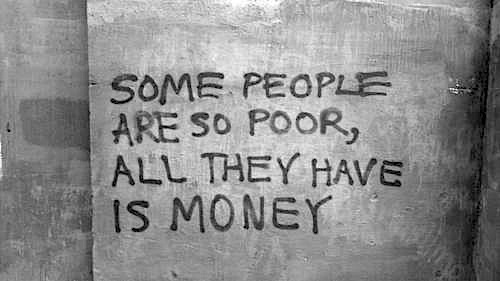

The view that a new car and fancy house (read new and/or grand) is a sign of financial success is an understandable one, given popular media’s portrayal of such possessions being the fruits of financial success. The only problem is that they are very superficial displays of wealth and in our debt driven world they are not necessarily a display of wealth at all, rather a display of someone’s consumption/spending preferences. From the outside looking in you don’t know how much of the car and house the bank/finance company owns.

A key finding of the research undertaken by Thomas Stanley and William Danko and published in the bestselling book The Millionaire Next Door was that displays of wealth, such as new cars and fancy houses were a poor indicator of true financial success. They found you were much more likely to find financially successful people driving a car that was more than a few years old, and a pretty run of the mill make/model, and living in the same house they’ve lived in for years in an established middle class suburb.

The problem with spending money on new cars is that this costs you a lot of money from which you receive questionable, if any, real benefits. OK, I know it feels and smells good, at least for a while, and you need to consider safety, but basically they are a wealth destroyer.

We all know 10%-20% of the value of the car disappears as soon as you drive it home. On top of this you have higher depreciation over subsequent years and higher running costs, such as insurance. If you repeat this frequently over decades the compounding cost of this financial disadvantage is huge. With cars it’s really only a question of how much they cost you. A little or a lot.

For houses the outcomes hopefully aren’t quite so bad, but the same principles apply. Hopefully the value of the property is increasing over time, unlike a car, but if you are frequently “upgrading” your home you are frequently incurring huge non-value adding costs via real estate agents commissions, stamp duty, legal’s and physical moving costs. If you are taking on debt to fund the upgrade you are also paying the bank interest for the privilege of living in your new house. Again, these costs can be huge over a lifetime.

All these costs have to be paid by you and they all represent a diversion of money from genuine investment and the accumulation of an asset base that will support your lifestyle in the absence of employment income. This is true financial wealth, as it represents the means to financial independence. Yes, I know you can consider your home an investment, but I’d like to see you live off it, while still living in it. A good question to ask is, “If we had no employment income for the next 6 months, what would happen?”

This is exactly what happened to many during the GFC, particularly in the US and Europe, and the house of cards came crashing down. The financed car was repossessed and the mortgage holder (bank) took possession of the house. I’m sure they didn’t think it was going to happen to them. Even if it just makes life really hard for a while, is it worth it?

While cars and houses is the focus of the above comments the same principles apply to many other expenses.

It’s worth asking the question, “What really makes me/us happy?”

That new car feel and smell fades, so it’s likely the happiness a new car provides fades also. The new house becomes the old house. You can either repeat the new car/new house process over and over to feel happy for a little while each time or start looking somewhere else for what is really important to you. I’d suggest the latter.

If you are buying new cars and fancy houses as a measure of success to meet the expectations you perceive other people have of you, I’ve got some bad news. They don’t really pay that much attention to you. They have their own lives to live. It’s only what is important to you that really matters.

Don’t paint me as a bike riding tree hugger. I love cars more than most and have more than I need, but I’m under no illusion my love of cars doesn’t cost me more than it should. I try to keep it in check and an important part in this is to understand what is really important to me and prioritising expenses accordingly. Cars don’t come at the expense of something more important.

We also own our home and while it clearly isn’t fancy in the eyes of our kids it has everything we need. Has for a number of years and should for plenty more to come.

What’s really important to you? When you have the answer/s to this question you will know where to direct your money to achieve both financial and personal success, as measured by you, and hopefully find lasting happiness.

Disclaimer

This advice is of a general nature only and may not be relevant to your particular circumstances. The circumstances of each person are different and you should seek advice from a financial planner who can consider if any strategies or products mentioned are right for you.