October 10, 2017

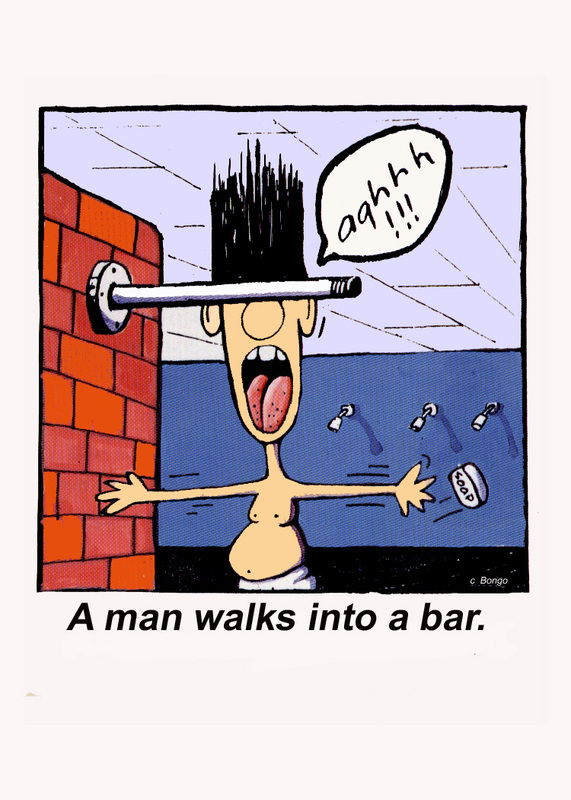

“A man walks into…” Like the cartoon above, a lot of jokes start with this line, but what I’m about to tell you is no joke. Unfortunately, it is very real and happening every day. Does this sound ridiculous? A man (or woman) walks into…. their local Toyota dealer. They are after a cost effective, reliable, value for money solution to their transport needs. Now […]